Are you struggling to make sense of your Shared Ownership lease? If so, you’re probably not alone! In this feature, we’ll run through some of your terms and conditions (T&Cs) and explain them in plain English.

Our starting point is Homes England’s model lease for Shared Ownership flats. (The terms and conditions for Shared Ownership flats are similar to those for Shared Ownership houses). We’ll go over the main sections of the lease and dive deeper into the most important terms.

HM Land Registry Prescribed Clauses

The section of your lease titled ‘HM Land Registry Prescribed Clauses’ includes a standard set of clauses. (A ‘clause’ is part of a written legal document). HM Land Registry uses this information to register your lease, so it’s vital that it is correct.

LR2. Title number(s)

First of all, what is a title? Title deeds are documents showing the chain of ownership for land and property.

When property is registered at HM Land Registry, it is allocated its own unique title number. The same property may have several different title numbers depending how many different people and/or companies have an interest in the property.

LR3. Parties to the lease

There will be at least two parties to your lease: you and your landlord.

Landlord

If your landlord is the freeholder then there might only be two parties to the lease. But not necessarily…

Tenant

The word ‘tenant’ explains the legal relationship between you and your landlord.

Assured tenancy is a form of leasehold. However, as an assured tenant, you have fewer rights and protections than leaseholders more generally. For example, if you were repossessed (e.g. for missing rent payments) you would have no legal right to the equity you invested in your property. Also, you have no legal right to lease extension (until you staircase to 100%, at which point you become a ‘conventional’ leaseholder rather than an assured tenant).

Other parties

Homes England’s model lease gives two examples of ‘other parties’: a management company and a guarantor.

Things get a bit complicated here, but bear with us. It’s important to understand the implications if there are a number of parties with an interest in your lease.

Let’s start with management companies. A freeholder owns the land your development stands on. But that freeholder might have sold on a ‘head lease’ to a developer / management company. And that developer / management company might have sold on an ‘underlease’ to a Housing Association (your landlord).

Does it matter how many companies have an interest in your lease? Yes! As a shared owner, you are responsible for all and any costs your landlord has to pay their landlord under the terms of their own lease. That could potentially include ground rent, the costs of your landlord extending their own lease, and/or the costs of any legal action undertaken by your landlord.

What about guarantors? A guarantor is a person who guarantees to pay a borrower's debt if they default on a loan obligation. However, your mortgage lender is unlikely to allow you to use a guarantor mortgage in combination with Shared Ownership. There is no legislation forbidding this, but lenders seem to prefer to avoid this additional complication.

It is worth checking how many companies have an interest in your lease. It’s quick and easy via the HM Land Registry site. Simply enter your postcode on this page to find a list of title deeds against your home. If you want to find out more, you can download these title deeds for £3 per document.

TOP TIP - It’s best to download title deeds and/or other information directly from the HM Land Registry website. Other companies offer this service but may charge considerably more.

TOP TIP – If you find that your landlord is not the freeholder, make sure your solicitor has reviewed the superior leases (between your landlord and their landlord, and between the head leaseholder and the freeholder).

LR6. Lease term

Historically, Shared Ownership homes came with a 99-year lease. This might sound like a long time. However it is, in fact, a ‘short’ lease. This is because leases go down in value once there are fewer than 80 years remaining. Unfortunately, lease extension becomes more expensive the longer you wait. And it becomes even more expensive once your lease drops below 80 years. So, anyone with a short lease could find themself facing a hefty lease extension bill before they have finished paying off the mortgage on their initial share.

The new model for Shared Ownership requires a minimum lease term of 990 years, which eliminates the lease extension problem for future shared owners. However, not all new-builds currently on the market were developed under the new model.

LR7. Premium

The premium is the amount you pay for your initial share. Say the initial market value is £300,000 and you buy 50%, you would pay a premium of £150,000.

LR12. Estate rentcharge burdening the Property

An estate rentcharge is not the same thing as ‘specified rent’ (the rent you pay to your landlord on their share). Rather, it is a mechanism for a third party – for example, a management company or developers – to secure contributions towards the costs of maintaining communal areas such as private roads or parks.

An estate rentcharge is also not the same as a service charge. For example, you have a legal right to be consulted when it comes to service charges, but not estate rentcharges.

TOP TIP - If your lease includes an estate rentcharge, make sure to discuss this with your solicitor, so you understand the implications and any related risks.

Particulars

Gross rent

Gross rent is the amount of rent that would be payable on 100% of the total market value of the property.

Initial Market Value

The ‘initial market value’ is used to calculate the price you pay for your share.

In setting sales prices, Registered Providers have to follow the requirements of the Capital Funding Guide (2022): ‘Providers must obtain valuations from a Royal Institution of Chartered Surveyors (RICS) qualified and registered valuer at the point of initial sale of a Shared Ownership home. The valuation must be carried out by an external valuer as defined in the RICS Red Book to ensure that the RICS valuer commissioned is an individual or organisation separate from the grant recipient.’

However, the RICS valuation simply sets a minimum benchmark for the point-of-sale price. The actual sales price may be higher.

TOP TIP – Buying a Shared Ownership home requires the same due diligence as purchasing a home on the open market. Check what other similar properties are selling for locally, and make sure you are happy with the sales price for your initial share.

Initial Repair Period

Generally speaking, as a shared owner, you are liable for 100% of all costs associated with your home. However, under the new model lease, there is a new ten-year ‘initial repair period’ (IRP).

During this IRP, the landlord is responsible for the cost of some repairs and cannot use the reserve fund (or ‘sinking fund’) to pay for repairs that are their responsibility, or use service charges to pay for external and structural repairs

Additionally, you can claim up to £500 a year from the landlord to cover specified repairs, replacements and maintenance costs. The allowance covers fixtures and fittings that supply water, gas or electricity (for example, sinks, baths and pipes) or heat your home (for example, radiators and boilers).

The ten-year IRP does not cover repairs covered by your building warranty or any other guarantee.

You are allowed to roll over any unused allowance to the following year, up to a maximum of one year’s allowance. And, if you sell your home, your allowance will usually transfer over to the new owner – unless they buy a 100% share. If you staircase to 100%, you will no longer be eligible for the allowance. As under previous versions of the model lease, once the IRP is over you are liable for 100% of all costs – regardless of the size of your share.

(If you are in a development with communal heating systems, your terms may be different).

You can find detailed information about the initial repair period in Schedule 9 of your lease.

Service Charges - Specified proportion

Under the heading ‘Specified Proportion’ you will find text saying: ‘means [ %] / [A fair and proper proportion of the Service Charge attributable to the Premises, such proportion to be conclusively determined by the Landlord (who shall act reasonably)].

This does NOT mean that you will be paying costs proportionate to your share. Rather, it is a way of explaining that costs will be shared between you and any other households liable for service charges. For example, say you bought a flat in a development, and your flat was one of ten identical flats. Assuming that service costs were allocated in proportion to floor area, each of the ten flats would be liable for 10% of total costs.

Specified Rent

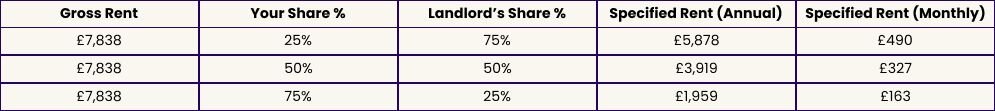

Under the heading ‘Specified Rent’ you will find text saying: ‘A sum equal to the Unacquired Percentage of the Gross Rent (the Specified Rent on the date of this lease being £[ ] [or (if greater) the Minimum Rent]).

This refers to the rent you will pay on the share held by the landlord. We’ve given some examples below to show how your initial rent could vary depending on the size of your share.

In the example above, we assumed the property has a market value of £285,000 (the average house price in March 2023 per the Office for National Statistics) and that Gross Rent is calculated as 2.75% of the Initial Market Value of the property.

Minimum Rent

According to the lease, ‘minimum rent’ means: ‘one peppercorn per month (if demanded)’.

In 16th and 17th century leases rent was, in fact, a single peppercorn per year. Presumably peppercorns were worth more then than they are now! However, by the 18th century the term ‘peppercorn’ had come to mean something of insignificant value. So, why include this term in the lease at all?

For a lease to be valid there has to be a ‘consideration’ – which, in the case of your Shared Ownership home, means rent. Of course, if you staircase to 100%, you no longer pay rent. However, if you look at Schedule 6 – Staircasing Provisions you will see that once you staircase to 100%: ‘the Specified Rent shall be reduced to the Minimum Rent’ (i.e. a peppercorn). This prevents your lease becoming invalid if you staircase to 100%.

Shared Ownership Lease

(1) Parties

Housing providers sometimes describe themselves as ‘not-for-profit’ or ‘charitable’. But this does not necessarily mean that they are registered with the Charity Commission. Some are, though others are ‘exempt’ charities. They are registered with the Regulator of Social Housing, and operate as a registered society as defined in the Co-operative and Community Societies Act 2014.

Agreed Terms - Market Value

We have already discussed initial market value, but this section provides more detail on valuations following your purchase of your initial share.

One important aspect is that market value disregards ‘any improvement made by the Leaseholder’. That means that, if you decide to staircase or extend your lease, you will not be penalised by a higher valuation if you have made improvements (say, a new kitchen) so long as you obtained your landlord’s written permission to carry out those improvements.

3.1. Pay rent

‘Specified Rent’ is the rent you pay to your landlord on their share.

3.6. Provide floor coverings

You might expect a new-build to come with floor coverings. However, as a shared owner, you may need to budget for these as the lease makes you responsible for providing: ‘suitable carpets or such other suitable floor coverings to the floors of the Premises’.

3.13. Landlord's right of inspection and right of repair

Your Shared Ownership lease gives your landlord the right to:

- Enter your home at ‘reasonable times’ to examine the condition, and to take a schedule of fixtures and fittings.

- Require you to undertake ‘repairs, works, replacements or removals’ within three months of notice if you have breached your lease contract.

- Undertake repairs, works, replacements or removals if you fail to act on a notice, and require you to pay for these.

3.13. Permit entry

This section explains the circumstances in which you are legally obliged to allow workpeople and others entry to your home.

3.18. Assignment and underletting

As a shared owner you do not have an automatic right to sublet your home. The Government says:

You can normally rent out (sublet) a room in the home, but you must live there at the same time. You cannot sublet your entire home unless either:

- you own a 100% share

- you have your landlord’s permission

Adding: ‘Your landlord will usually only give permission in exceptional circumstances’.

Different Housing Associations have different policies. However, you should expect ‘exceptional circumstances’ to be narrowly defined. The example given by the Government is: ‘if you’re a member of the armed forces and are serving away from the area where you live for a fixed period’.

Some shared owners report being denied permission to sublet where they have a temporary job in another part of the country, or are unable to sell a Shared Ownership home that has become unsuitable for their needs.

5.3. Repair redecorate renew structure

This section outlines your landlord’s responsibility to repair, redecorate, renew and improve the building - including the structure, external fabric, and common parts.

This does not mean that the landlord will pay for these works, although this is a relatively common misunderstanding. As a shared owner you have 100% liability to pay costs regardless of the size of your share - subject to the initial repair period (if applicable) and/or any arrangements related to building safety issues.

9. SDLT Certificate

You have two options when it comes to Stamp Duty Land Tax (SDLT):

- Option A - to pay SDLT on 100% value of property

- Option B – to only pay SDLT on % share being purchased

TOP TIP - You might be tempted to go for whichever appears to be the cheaper of these two options. However, SDLT is complex and the option that appears cheaper when you purchase your initial share might end up being more expensive over time.

For more information about SDLT take a look at our article: Should I pay my Shared Ownership Stamp Duty (SDLT) in stages or in one go?. Should you want to work out how much Stamp Duty you might have to pay when purchasing your Shared Ownership home, you can try our Shared Ownership Stamp Dury Calculator.

Schedule 5 – Rent Review

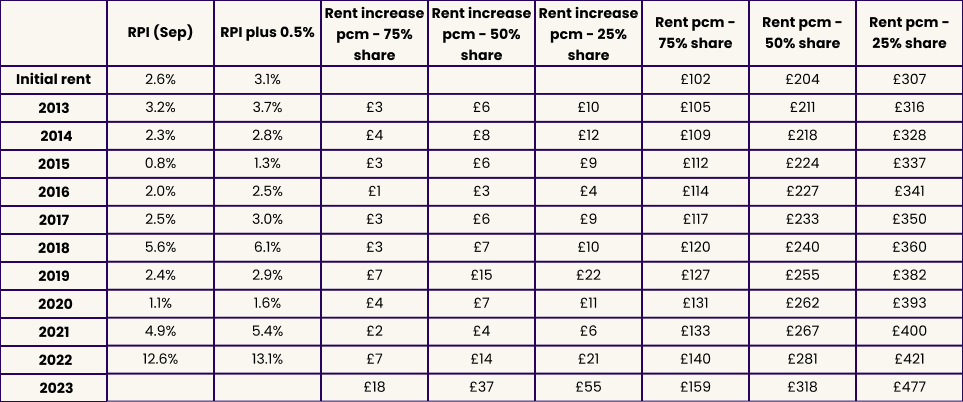

This section explains how your annual rent review is calculated. There are two key aspects to be aware of. Firstly, although annual rent increases are ‘capped’, this is at a rate slightly above inflation. RPI (Retail Price Index) and CPI (Consumer Price Index) are two different measures of inflation. Social rent tenancy agreements use CPI to calculate rent increases whereas Shared Ownership leases use RPI (which tends to be slightly higher than CPI).

The current model lease states that the annual rent increase is calculated as RPI plus 0.5%. The table below explains how this might look in practice. In this example, we have assumed that the initial market value of the property was £178,406 (the average property price in December 2012 per the UK House Price Index for England) and that initial rent was calculated as 2.75% of the landlord’s share.

The model lease requires that annual rent reviews are calculated on an ‘upwards only’ basis. This means that your rent will never decrease even if inflation goes down. In fact, it will always increase, by at least 0.5%.

* In practice, many housing providers (though not all) applied a rent cap of 7% in 2023, due to the cost of living crisis. But it is sensible not to assume rent caps will always be put in place when inflation is high.

Schedule 6 – Staircasing Provisions

This section of your lease specifies how you go about staircasing (buying more shares). One of the key aspects to be aware of here is that the premium for staircasing is calculated using current market value. This means if your home goes up in value, the cost of buying additional shares will also go up. For more information on staircasing valuations you can read our article RICS valuations for staircasing: top things you should know.

Your lease is likely to include the following sentence: ‘At any time within three months of the Valuer's determination the Leaseholder may pay for a Portioned Percentage in accordance with the provisions of paragraph 1.5’. This means that, if the process takes longer than three months, you may need to pay for a second valuation.

Depending on the date of your lease, you might also see the following sentence: ‘The rights in this Schedule 6 are separate to the rights set out in Schedule 10 relating to 1% Staircasing and the Leaseholder should consider both sets of provisions when considering increasing their Acquired Percentage.’ One of the key differences between the standard model for Shared Ownership and the new model is that the new model permits staircasing in 1% increments. Schedule 10 provides more information on this as it uses a different process than standard staircasing arrangements.

TOP TIP – Some shared owners report problems selling larger shares (though this probably depends on the availability of Shared Ownership homes in your local area). If you intend to sell on at some point, check it is financially beneficial to staircase up to a large share if you may find it difficult to staircase all the way to 100%.

Schedule 10 – 1% staircasing

This section specifies how to go about staircasing in 1% increments. You will probably need to fund this via savings (as the amounts will be too small to take out a mortgage).

TOP TIP - Depending on your rent, current mortgage rates, the terms of your mortgage and your plans for your home it is probably worth considering which is more financially beneficial – buying an additional 1% share or overpaying your mortgage.

Do you want to get an HPI valuation of your home for a 1% staircase? Sign up with Stairpay to get a free HPI valuation.

Do your own research!

Lease contracts are legally complex, particularly Shared Ownership leases. And everybody’s situation is different. This article is intended to help you have an informed conversation with your solicitor. It is not intended to substitute for taking independent, expert legal advice.