In this feature, we explain three different aspects of your mortgage which determine how much it will cost:

- your deposit

- the interest rate, and

- the term (the amount of time you will take to repay your mortgage).

We’ll use scenarios to illustrate the financial impact of different choices.

Bear in mind that these scenarios are indicative only. They are intended to explain broad principles rather than provide an accurate calculation of how much you might actually pay. For example, to keep things simple, each scenario assumes you pay the same rate of interest throughout your mortgage term. In practice, rates will vary over time.

Capital and interest

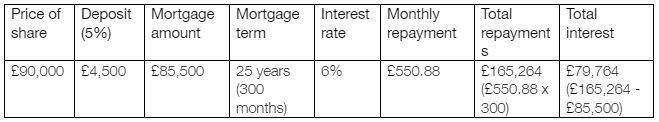

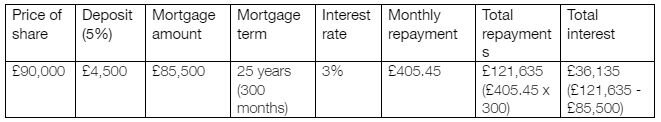

The amount you borrow is known as the capital. Say your share costs £90,000 and you put down a 5% (£4,500) deposit. Your mortgage capital is £85,500 (£90,000 less £4,500).

As with any loan, you pay interest on the amount you have borrowed. Consequently, your monthly repayments will consist of capital repayments plus interest. At the beginning of your mortgage term, most of your monthly repayment goes towards covering interest. The opposite applies towards the end of your mortgage term. By then you will have considerably reduced the amount of capital you still need to repay to your lender. So there will be less interest to pay, and more of each monthly repayment will go towards reducing your capital to zero.

Deposit amount

When you put down a mortgage deposit, you are paying for a chunk of your home upfront. Your mortgage is what allows you to pay the remainder of the cost.

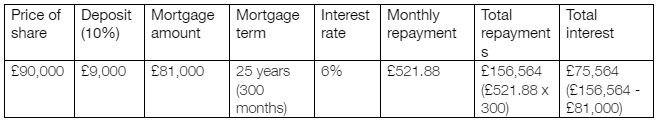

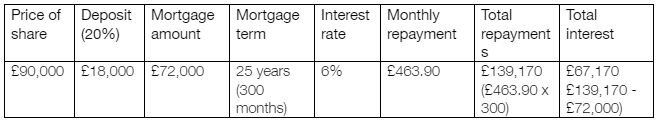

In this example, we have assumed that you will take out a 25-year mortgage, and that your interest rate is 6%.

Of course, the larger deposit you can afford, the less you need to borrow, which should reduce your monthly repayments. By putting down a 10% deposit, instead of a 5% deposit, you could reduce the amount you need to borrow by £4,500. This would reduce your monthly repayments.

Putting down a 20% deposit would reduce your monthly mortgage repayments even further.

Although we have used the same interest rate in all three examples in this section, putting down a larger deposit should also allow you to access a better interest rate.

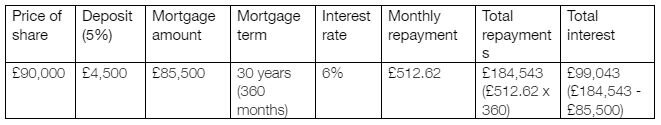

Mortgage interest rate

Typical mortgage interest rates vary over time. The UK experienced a prolonged period of low interest rates, but these have been on the rise recently.

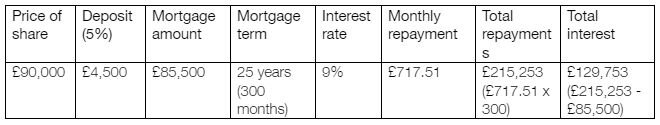

You will inevitably pay different interest rates at different points in your mortgage journey. So it is vital to think about whether you could afford your mortgage repayments if interest rates went up. The Government’s MoneyHelper site says: “Make sure you can afford it!” giving the example of a 3% increase in mortgage rates. Though, if you are on a fixed rate deal, any rises won’t affect you till you come to the end of your deal.

Bear in mind there is no upper limit on how high rates could rise. (In the late 1970s they reached a whopping 17%, at a time when rising wages and oil prices were driving a surge in inflation).

Of course, mortgage rates can go down as well as up. The following example shows how your monthly repayments would decrease if mortgage interest rates went down.

Typical mortgage interest rates will depend on the wider economic environment. However, the specific rate you are offered will depend on a range of factors including:

- your credit risk (the possibility you may fail to repay your mortgage)

- what size deposit you can afford, and

- whether you choose to fix your rate and, if so, for how long.

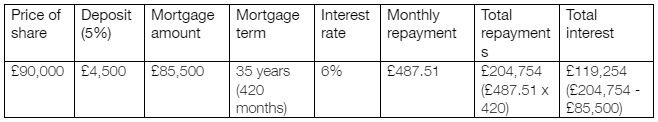

Mortgage term

Historically, homebuyers have taken out 25-year mortgage terms. However, rising property prices mean that increasing numbers are taking out longer terms to make monthly repayments more affordable.

One study found that 37% of first-time buyers had a mortgage term longer than 25 years in 2006, and that this had risen to 66% by 2018.

The longer your term, the more your mortgage will cost.

Can I reduce the cost of my mortgage?

Many mortgage products allow you to overpay, perhaps by up to 10%. Overpayments go towards paying off your capital and will therefore reduce the amount of interest you need to pay. This could reduce your monthly repayments (or reduce your mortgage term).

Do your own research!

Make sure your monthly repayments are affordable. Will you have a high enough income to live comfortably in your Shared Ownership home as time goes on?

Online tools - such as the government’s MoneyHelper Mortgage Calculator - can help you understand potential costs of different mortgage options. But everyone’s situation is different, so it’s essential to take expert advice from an Independent Financial Advisor or mortgage lender.

Additional resources

MoneyHelper – Mortgage Calculator